Highlights from Tmall-Kearny report: Insights on Private Domain Outdoor Sports

The public’s knowledge of sports health has grown due to the pandemic, and an increasing number of individuals have begun to participate in physical activity and increase their frequency of exercise. Tmall, one of China’s biggest e-commerce platforms, and Kearney, a renowned worldwide management consulting business, recently produced insightful research on the trend of private domain outdoor sports, which details the present phenomena and trend of consumers’ sports brand consumption.

What will sport look like in the future?

In 2021, China’s per capita GDP will exceed 12,000 US dollars. The continuous growth of per capita GDP and the rapid rise of the middle class in first- and second-tier cities promote the refinement and upgrading of outdoor demand for mass sports.

Skiing, diving, surfing, rock climbing, and other high-end outdoor activities are currently available. As a result, sports have grown in popularity tremendously. The varieties of outdoor sports in China are projected to improve in the future as the economy continues to expand, in order to suit the diversified sports consumption demands of the people.

Benefiting from the rapid growth of ice and snow sports, outdoor camping, and other categories, the sales growth rate of consumer groups in high-tier cities is still strong, higher than the overall growth rate of outdoor sports.

Consumers under 35 are still the primary purchasers in the consumer group, accounting for 55% of the total number. The growth rate of middle-aged and elderly consumers in the past two years is undeniable, especially the “silver-haired people” over 60 years old, both in terms of number and consumption amount are above 40%

There are three categories of sports products with an upward trend:

The vacation camping sector has also seen tremendous growth in the last year, which is inextricably linked to the current development of outdoor camping initiatives. At the same time, it depicts the geographical shift of outdoor sports initiatives from urban to suburban locations from a more profound viewpoint. The extension of time from working days to holidays and weekends.

Due to the success of the Beijing Winter Olympics, developing potential populations for ice and snow sports is a significant business opportunity in the future. According to statistics from China’s Ministry of Culture and Tourism’s data center, the themes “Winter Olympics” and “Skiing” will grow in popularity among tourists during the Spring Festival vacation in 2022. The same may be said with Ctrip data. The keyword “Winter Olympics” surged in popularity by 200 percent. Ski ticket purchases climbed by 33% in the three days preceding the Spring Festival compared to 2021. During the Spring Festival vacation, enjoying the snow during the day, playing in the snow, staying in a hotel, bathing in hot springs at night, and celebrating a joyful new year has become the recent trend of cultural tourist consumption most appropriate for the Chinese people.

Industry insiders said that technology is the most critical link in the competition between domestic and international brands. Enhancing the technological gold content of products enhances the brand’s value and influence. Encourage enterprise research and development, improve the independent innovation ability of technology, and realize domestic substitution in more fields.

Categories such as yoga and fitness equipment have gradually declined and stabilized after the rapid growth during the epidemic, but this does not mean that the growth space is exhausted. But needs to be closely integrated with online content and training.

The transformation of consumer experience

Consumers’ cognition of brands and consumption behaviors has become more accessible and freer from commodity attributes in the traditional sense. They pay more attention to the lifestyle behind the products. Essentially, consumers are pursuing different physical and mental health lifestyles. The rise of emerging social platforms has accelerated this trend.

For outdoor sports brands, what needs to be solved in the face of such a trend is how to transform from business logic based on product attributes such as style, price, and promotion to creating a “pleasant/interesting” experience for consumers. More importantly, it has completed the transformation of consumers from understanding to experience.

Establishing a “new experience” is not entirely consistent for different categories of brands at different stages. It is necessary to fully consider various factors such as the brand’s development stage, organizational form, consumer size, etc., to formulate an experience that conforms to the brand’s characteristics. Strategy. Generally speaking, experience strategies include consumer visual experience centered on personalized content, interactive consumer experience centered on brand value delivery, and immersive consumer experience built around consumer needs.

How it changes brand positioning

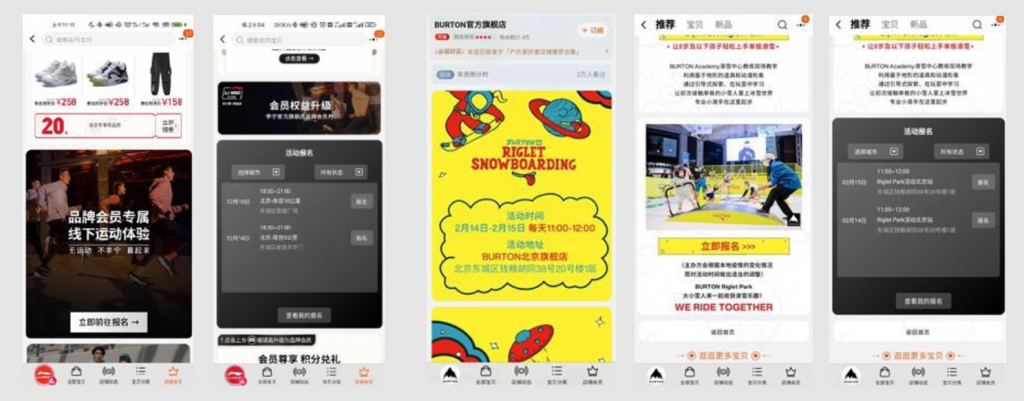

The outdoor sports private traffic methodology responds to new opportunities and new challenges. By reconstructing the relationship with consumers, providing an integrated brand experience of “seeing, playing, and buying” and improving efficiency under the new consumption flow line, the brand’s sustainable growth can be achieved. Here are some cases:

LI NING

Li Ning is one of the first brands to lead the “national trend,” and the brand’s customer experience is steadily built. The existing offline sports experience, such as running reservations, will also allow online consumers to have a strong perception, thereby improving consumers’ experience in various channels.

As an old foreign ski brand, Burton hopes to drive consumer behavior through the Tmall platform and tries to open the offline teaching registration of Burton academy ski center on the Tmall platform, using the power of the platform to cultivate skiing concepts for consumers.

This year, Li Ning and Burton vigorously develop cross-regional consumer experience consistency, hoping to provide Tmall consumers with a scarce service experience.

ECCO

As a famous shoe brand in Nordic Denmark, ECCO is committed to creating an immersive online interactive community to bring more young outdoor users a digitally immersive experience that integrates offline and online platforms.

Brand participation can consist of themed activities or online interactive games, and the core is to strengthen consumers’ cognition and recognition of the brand. Emphasizing the upgrade of the interactive experience itself is weakening the sales color to a certain extent, and more is strengthening the emotional perception of consumers. Improve consumers’ initiative, enthusiasm, and even fission ability in the community environment after entering the store so that the brand’s voice and business growth in the younger generation.

ECCO Aibu plans this community into four interactive modules, with content and community currency as the penetration, to create a digital online community: “Player Route” module, “AR shoe” module, “Cloud ECCO” module, and “Player Paradise” module.

ANTA

In the past, Anta’s store operations on Tmall relied more on the experience of operators. With the surge in-store visitors, brands face the pressure of post-visitor link conversion. The core opportunity for brands is how to convert store visitors into brand-loyal consumers who have a deep relationship with the brand.

Digitalization of store operations: The brand cooperates with the platform to realize the transparency of private domain data for the first time and create a consumer dynamic map. Finally, the above digital capabilities can help brands locate the operation level of the private domain, find the optimization space, and ultimately realize the personal field’s effective operation and efficient transformation.

Changes in “Central brand positioning”

Integrate the link functions around brand and marketing, form a market organization around product design and brand communication, create a central brand positioning, and operate channel sales as an independent department specialized. Leading sports and outdoor enterprises are gradually getting rid of the business model highly dependent on offline channel distribution and moving towards an emerging route of driving price increases with brand value and leveraging D2C global marketing to increase sales.

Therefore, more and more enterprises have become a typical central brand positioning organization, forming a solid consumer mind of a single brand. However, after some companies have created a cross-price and multi-category brand map through acquisition, it is more suitable to integrate various brand alienation resources in the brand division.

Unlock New China during the COVID era

Entering the Chinese market takes time and extensive research as well as a deep understanding of consumer insights, trends, and local behaviors. Engaging in all these activities may be expensive and impossible for small to medium-sized businesses around the world. With the added constraints of COVID-19, finding an efficient and cost-effective solution is vital to unlocking the potential of the Chinese market. However, finding partners that can digest both the international and local Chinese perspectives can be hard and risky.

Under the goal of connecting global cultures to the Chinese youth, Shake to Win has been facilitating China market access for SMEs, cultural organizations, as well as public institutions from all over the world, building commercial and emotional bridges between distinct nations and helping Chinese consumers to reach the most unique places, products, and people. We offer an extensive range of services including localization, social media, online marketing, offline campaigns, e-commerce, and more, leaving you to focus on your business without the need to learn Chinese from your local destination. For more information or business collaboration please contact, partnership@shaketowin.net.